A few years ago, pure play SD-WAN startups seemed poised to disrupt some of the traditional networking giants. But over the past three years, all of the biggest names in the market have gotten acquired by them instead. The acquisition of Silver Peak by HPE almost feels like the end of an era. Why did SD-WAN go corporate since 2017, and how has the vision of what SD-WAN can do changed since then? Rich Stroffolino breaks it down in this episode.

Transcript of Checksum Episode 11: SD-WAN Goes Corporate

Last week, HPE formerly announced that it was acquiring the SD-WAN startup, Silver Peak, for just under $1 billion. They plan to integrate that into their well established Aruba business unit and use the SD-WAN tech to further build out their edge services network. The move makes a lot of sense for HPE and gives the Silver Peak folks a nice exit.

But the moves also mark the end of a transition for SD-WAN that really started up back in 2017. Since that time, SD-WAN has gone from emerging technology to networking staple. So when did SD-WAN go corporate?

This video isn’t setting out to break down why HPE bought Silver Peak. For that, check out the Gestalt IT Rundown from July 15th, as Tom Hollingsworth did a great job with that.

Instead, I wanted to talk today about the disappearance of the big “independent” pure play SD-WAN players over the past several years. The term SD-WAN for a network abstracted from its hardware using a virtualized network overlay started getting thrown around in 2014. For those next few years, there were three pretty clear distinctions of SD-WAN providers in the market.

First up, you had existing networking infrastructure giants who were adapting to this new paradigm. Cisco came out pretty early with an SD-WAN solution with IWAN, although being early, in this case, didn’t exactly mean that Cisco had a market-leading product. For these incumbents, SD-WAN was a natural extension of their ubiquitous network presence.

The next category would be SD-WAN pivoters. These were companies that were in adjacent fields, like WAN optimization or network security, looking to make a play in the market. Riverbed and Fortinet both fit into this category as an example. While infrastructure companies saw SD-WAN as filling out their catalog, the pivoters, I think, saw SD-WAN as an evolution of their existing solutions, hence why you see more different approaches in this space.

Finally, you have the pure play SD-WAN companies, the emerging startups that were founded to disrupt traditional networking in this space. There are still a lot of startups in this space, but some of the most well funded and stocked with talent were Viptela, VeloCloud, CloudGenix, and Silver Peak.

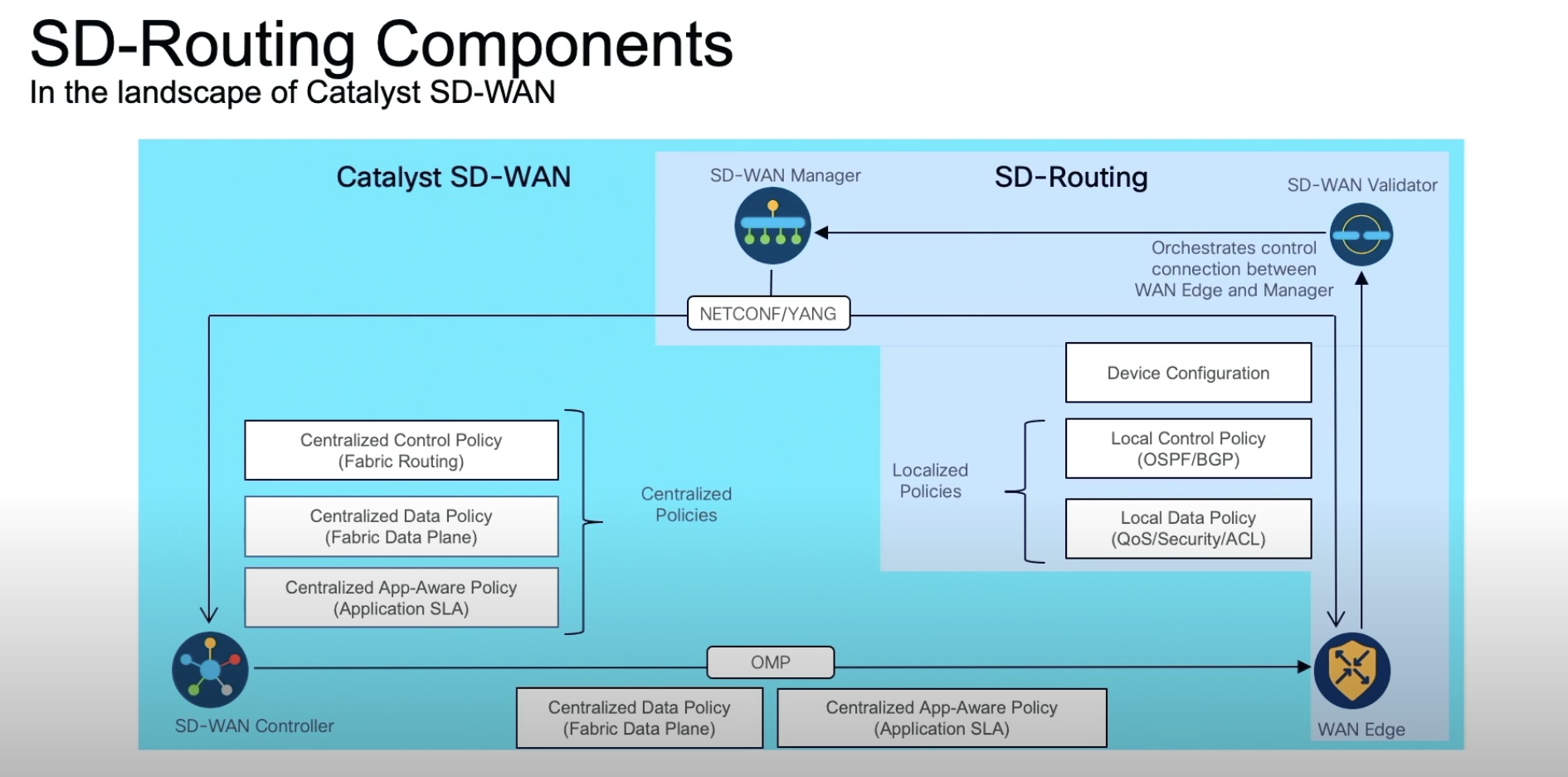

The first to go corporate was Viptela, getting acquired by Cisco in May 2017 for $610 million. This raised a lot of eyebrows and said how competitive Cisco saw its IWAN solution against the pure play competition. This gave Cisco a cloud-first SD-WAN solution that offered sophisticated segmentation support needed by service providers and large enterprises. Since then, Cisco has done a good job rolling out support for Viptela’s SD-WAN across routers running IOS XE. On the surface, it left them with a bit of a mess of overlapping solutions with IWAN, Viptela and Meraki’s cloud-managed networking, but Cisco has kept the messaging of these fairly clear.

Soon after that was VeloCloud, which got bought by VMware later in 2017 for about $450 million. This furthered VMware’s networking ambitions, which first got into network virtualizations with its Nicira acquisition in 2012. The VeloCloud acquisition though seemed squarely focused on the company’s strength with Service providers. VeloCloud already had 50 service provider partnerships in place at the time of the acquisition and delivered their SD-WAN appliances as a virtual network function on Universal Customer Premises Equipment commonly used by those clients.

These acquisitions seemed to not just validate SD-WAN as a technology, but ensured that they would be integrated on a very fundamental level across the networking stack. Both Cisco and VMware further invested in, or at least hedged against, the emerging tide of the disaggregated data center.

CloudGenix’s acquisition came several years later than these two blockbuster deals, getting swallowed up by Palo Alto earlier this year for $420 million. This acquisition felt more like Palo Alto seeing SD-WAN as a logical extension of their secure access service edge. I’d put it in the SD-WAN pivoter camp, even though Palo Alto has been working on this for a while. If you want to get deep in the weeds on SASE, be sure to check out the Tomversation episode where Tom Hollingsworth breaks down the category.

HPE’s acquisition of Silver Peak could be seen in much the same light since the team will be integrated into the Aruba SD-Edge portfolio. But given how much more HPE paid for the company, their sizable existing customer base at the time of the acquisition, and their very mature SD-WAN stack, I imagine Aruba has much more ambitious plans for Silver Peak than just a pure SASE play.

There are still a ton of SD-WAN startups out there, but Silver Peak’s acquisition seems like a passing of the torch. They might be the last of the pure-play SD-WAN networking stack out there. This makes sense as we’ve seen SD-WAN mature from a way to connect branch offices and headquarters together over a software-defined network, to include more specific use cases, like cloud on-ramps, or as a component of securing the edge. In this way, SD-WAN has become an important feature across other networking categories, but probably has a harder time operating as a stand-alone product. And when it comes to features, it’s not surprising to see companies like Cisco, VMware, or Palo Alto, who’d rather buy than build.