News came out today in The Marker that Microsoft is looking into an acquisition of Mellanox. This would likely mark a major shift to in-house hardware development for Azure, and could form the basis of a composable cloud offering in Microsoft’s cloud. But it would also take a major (if un-heralded) player out of the market for everyone else.

Is Microsoft buying Mellanox? It’s all speculation right now, and so is this article!

Not Just About Hardware

Microsoft’s current Azure networking environment is said to leverage Mellanox Ethernet adapters with on-board FPGAs talking to Arista switches. The company already relies heavily on this tuned networking stack, so it’s no surprise that CNBC had speculated that FPGA-maker Xilinx was also interested in Mellanox. Perhaps Microsoft sensed a supplier squeeze and moved to act first to control their own destiny. It is also possible that Microsoft was already moving away from their FPGA-driven solution to custom silicon co-developed with Mellanox. This would bump Xilinx out of the picture.

One also wonders about the implication for Arista, the main provider of Ethernet switches inside Azure. Microsoft is one of Arista’s largest customers, said to account for as much as 16% of the company’s sales last year. If Microsoft leveraged in-house Mellanox-based switches, this would represent a sizable shift in spending for the company and could help Azure compete with Amazon’s AWS. Still, it’s unclear how Microsoft would justify a $5 billion plus acquisition based on cost savings alone.

Composable Azure

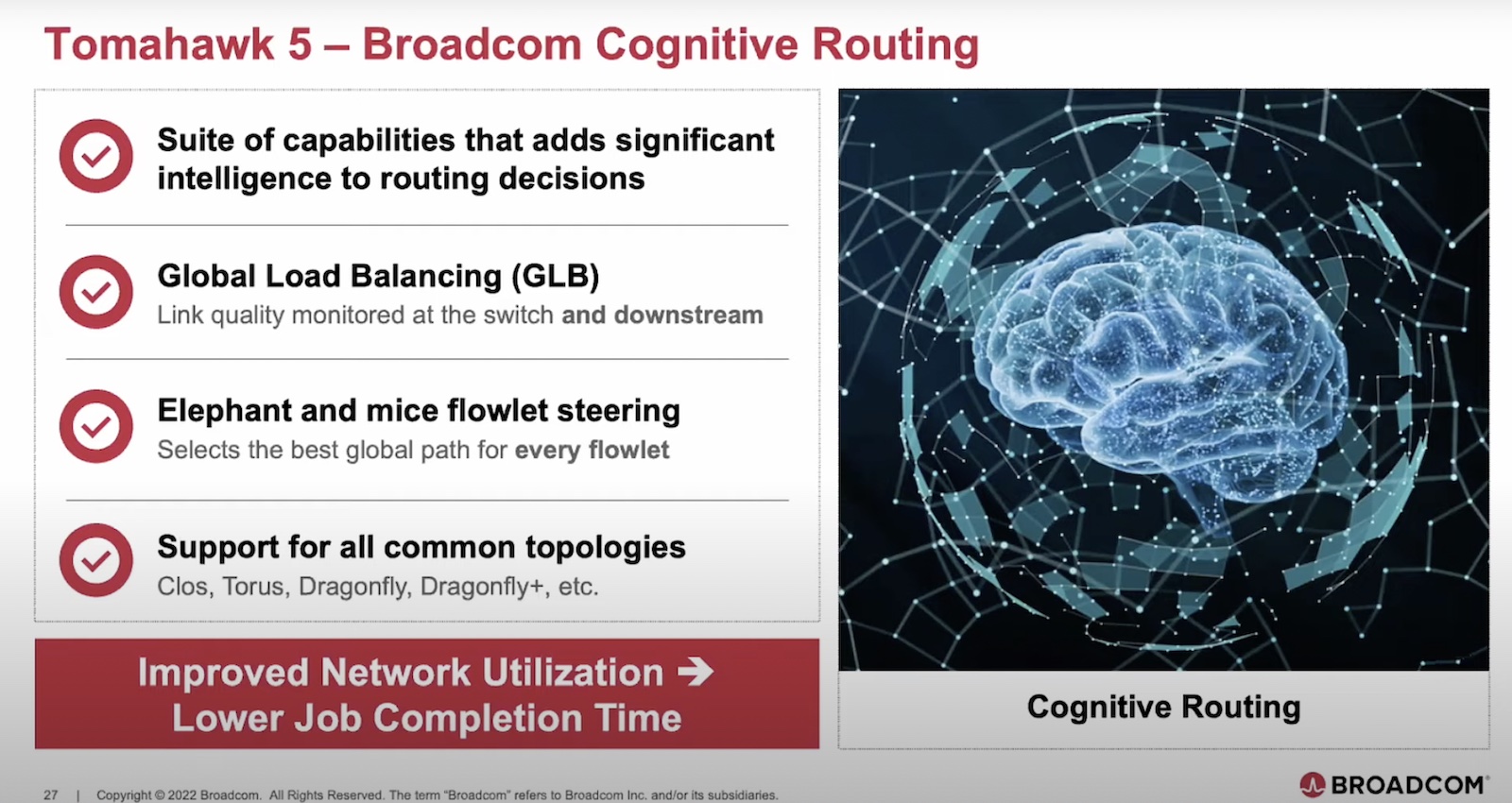

I would suggest that a more likely justification for such an acquisition would be to differentiate the Azure service offering from other cloud providers. Mellanox is the master of advanced network fabric technology, including both Ethernet with RDMA over Converged Ethernet (RoCE) and InfiniBand. Microsoft already uses and supports this technology and one can imagine the two companies building a composable cloud infrastructure platform based on it.

Composable infrastructure links dispersed resources (CPU, storage, network, GPU, FPGA, etc) over a flexible, low-latency, high-speed fabric. Mellanox is the switching provider for the HPE Synergy composable platform, for example, and provides NVMe-over-Fabrics technology for high-speed storage. Combine this with Microsoft’s well-regarded Azure cloud orchestration and management technology and you’ve got a remarkable infrastructure as a service (IaaS) offering. And if Microsoft owns the core switching technology, it would be very difficult for others to compete.

Bad News For Everyone Else

Although Mellanox isn’t as widely known as some tech companies, their products have long been held in high regard. Oracle, which once owned 10% of the company but has been divesting lately, is said to remain a big customer. Mellanox is a major OEM for HPE, Dell EMC, Lenovo, and IBM. And the company dominates the InfiniBand market, such as it is.

Microsoft would be unlikely to continue product development, focusing the company on the Azure solution outlined above. This would cause a disruption in the client-side Ethernet market, especially for users of RoCE. All those OEMs would have to scramble to find a new high-performance Ethernet provider.

The deal would also spell the end for InfiniBand as a viable networking architecture, unless Microsoft struck a deal to spin out those products to another company. This would have ripple effects, especially in the storage industry, and could even signal a positive shift for Fibre Channel. Or it could hasten the move to Ethernet-based RDMA solutions in enterprise storage.

Although Arista would lose a major customer, they are big enough now to weather this storm. They have already reduced their reliance on sales to Microsoft and would actually benefit somewhat from one less Ethernet switch vendor in the market.

Stephen’s Stance

Amazon’s triumphant AWS re:Invent event showed just how strong they are becoming in the enterprise, even as Microsoft’s Azure continues to attract big customers. If this move leads to a novel composable cloud platform for Azure, it would help solidify the two-horse race for dominance in public cloud. That’s the only way the acquisition of Mellanox would make sense for Microsoft. Otherwise, I expect Xilinx (or perhaps Broadcom) to take over.